About E-Invoicing

An e-Invoice is a digital representation of a transaction between a supplier and a buyer. e-Invoice replaces paper or electronic documents such as invoices, credit notes, and debit notes.

An e-Invoice contains the same essential information as traditional document, for example, supplier’s and buyer’s details, item description, quantity, price excluding tax, tax, and total amount, which records transaction data for daily business operations.

Benefit of E-Invoice

The implementation of e-Invoice not only provides seamless experience to taxpayers, but it also improves business efficiency and increases tax compliance. Overall benefits include:

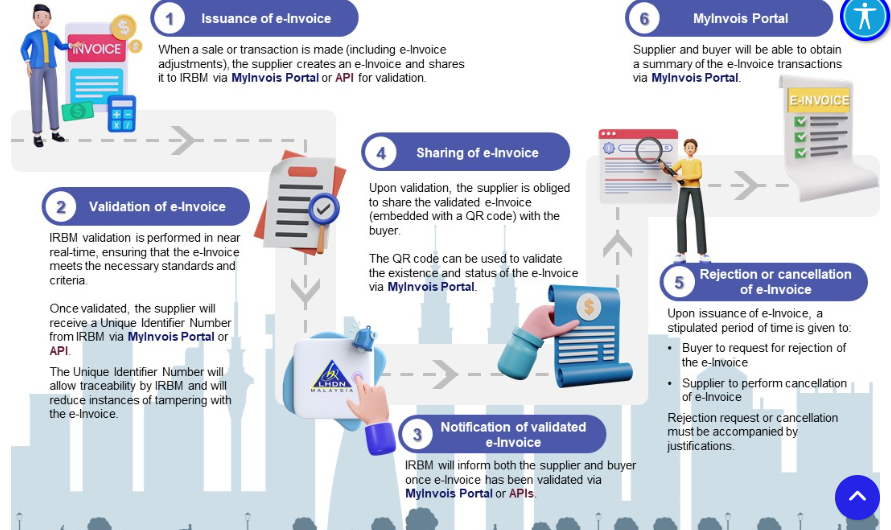

Overview of the e-Invoice Model

To facilitate transition to e-Invoice, taxpayers can select the most suitable mechanism to transmit e-Invoices to IRBM, based on their business requirements and specific situation.

There are two (2) options for the e-Invoice transmission mechanisms for taxpayers selection:

- MyInvois Portal

- A portal hosted by IRBM

- Accessible to all taxpayers at no cost

- Also accessible to taxpayers who need to issue e-Invoice where Application Programming Interface (API) connection is unavailable

- Application Programming Interface (API)

- An API is a set of programming code that enables direct data transmission between the taxpayers’ system and MyInvois system

- Requires upfront investment in technology and adjustments to taxpayers existing systems

- Ideal for large taxpayers or businesses with substantial transaction volumes

The figure below demonstrates an overview of the e-Invoice workflow from the point a sale is made or transaction is undertaken, and an e-Invoice is issued by the supplier via MyInvois Portal or API, up to the point of storing validated e-Invoices on IRBM’s database for taxpayers to view their respective historical e-Invoices.

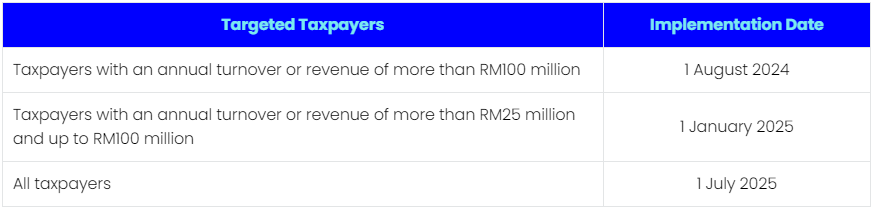

E-Invoice Implementation Timeline

e-Invoice will be implemented in phases to ensure smooth transition. The roll-out of e-Invoice has been planned with careful consideration, taking into account the turnover or revenue thresholds, to provide taxpayers with sufficient time to prepare and adapt to the e-Invoice implementation.

Below is the e-Invoice implementation timeline: